Complete Guide to Posting Key T Code in SAP (2025)

Complete Guide to Posting Key T Code in SAP: A Posting Key T Code in SAP is a two-digit code that defines how a financial line item is posted in the system. It determines:

- Whether the entry is a debit or credit

- The account type involved (General Ledger, Customer, Vendor, or Asset)

- The field status for data input (which fields are required, optional, or hidden)

Example:

| Posting Key | Description | Account Type |

|---|---|---|

| 40 | Debit to G/L Account | G/L |

| 50 | Credit to G/L Account | G/L |

Why Are Posting Key T Codes Important?

Posting Key T Codes provide a standardized structure for all financial postings in SAP. They are used by essential transaction codes such as FB50, F-02, FB60, and F-90.

Benefits:

- Ensures structured financial entries

- Improves consistency and reduces posting errors

- Supports audit readiness and financial compliance

- Determines which fields appear on the data entry screen

Commonly Used Posting Key T Codes in SAP

| Posting Key | Description | Account Type |

|---|---|---|

| 40 | Debit to G/L Account | G/L |

| 50 | Credit to G/L Account | G/L |

| 15 | Customer Debit | Customer |

| 31 | Vendor Credit | Vendor |

| 70 | Customer Invoice (Debit) | Customer |

| 75 | Customer Credit Memo | Customer |

| 96 | Asset Credit | Asset |

All posting keys are stored in SAP Table TBSL and can be managed using T-Code OB41.

Use Cases and Practical Examples

General Ledger Postings (F-02 or FB50):

- 40 = Debit expense account (e.g., rent, salaries)

- 50 = Credit liability account (e.g., accounts payable)

Customer Accounting (FB70, FB75):

- 70 = Debit customer account for invoices

- 75 = Credit customer account for returns or adjustments

Vendor Postings (FB60, F-43):

- 31 = Credit vendor account

- 40 = Debit expense or asset account

Asset Accounting (F-90):

- 96 = Credit to asset account during asset retirement or adjustment

Access and Configuration

| Action | SAP T-Code |

|---|---|

| View or Configure Posting Keys | OB41 |

| Display Posting Key Table (TBSL) | SE11 |

| Post Financial Document | F-02 |

| Post Vendor Invoice | FB60 |

| Post Customer Invoice | FB70 |

| Asset Purchase Entry | F-90 |

Frequently Asked Questions (FAQs)

1. What is a Posting Key in SAP?

A two-digit code that specifies the nature (debit/credit) and account type for financial entries.

2. What does Posting Key 40 mean?

It is used to post a debit to a G/L account.

3. What does Posting Key 50 mean?

It is used to post a credit to a G/L account.

4. How is Posting Key 15 used?

For customer debit postings, usually during invoice creation.

5. What is Posting Key 31?

Used to post a credit to a vendor account.

6. What does Posting Key 70 indicate?

Used for posting customer invoices.

7. When do we use Posting Key 75?

For customer credit memos, reversing or adjusting an invoice.

8. What is the use of Posting Key 96?

To post a credit to an asset account, typically during retirement or correction.

9. Where can I find all Posting Keys in SAP?

Use T-Code OB41 to view and manage them or display the TBSL table via SE11.

10. What happens if I use the wrong Posting Key?

You can reverse the document using FB08 or correct it with a manual entry in F-02.

Summary Table of Key Posting Keys

| Posting Key | Function |

|---|---|

| 40 | Debit to G/L |

| 50 | Credit to G/L |

| 15 | Customer Debit |

| 31 | Vendor Credit |

| 70 | Customer Invoice (Debit Entry) |

| 75 | Customer Credit Memo |

| 96 | Asset Credit |

Learning Posting Keys Practically

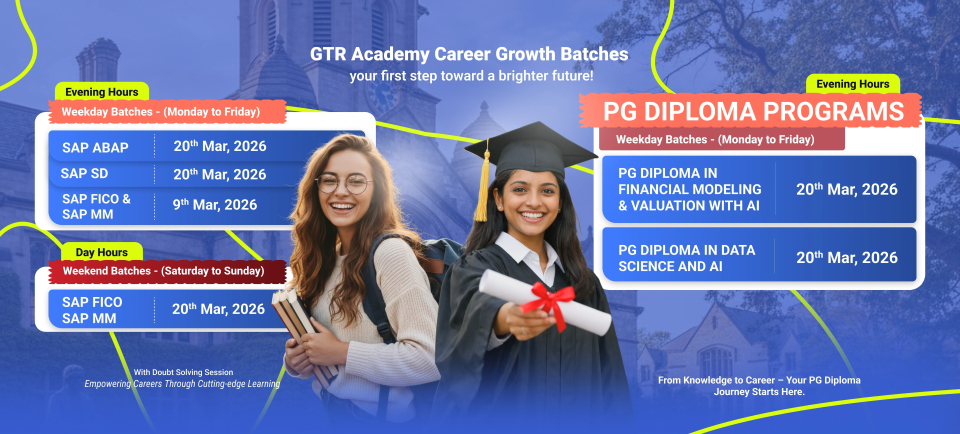

If you’re serious about mastering posting keys and their application in SAP, consider joining a practical training program like the SAP FICO course at GTR Academy, which includes:

- Live SAP server access

- Real-world business case exercises

- Step-by-step walkthroughs for common T-codes

- Certification preparation and job placement support

Final Thoughts

Mastering SAP Posting Key T Codes is essential for:

- SAP FICO Consultants

- Financial Accountants

- ERP Analysts

- Anyone working in SAP-based financial environments

It ensures accurate transaction processing, enhances reporting integrity, and prepares you for real-world SAP implementations.

For a complete hands-on learning experience, GTR Academy offers both online and offline training programs tailored to beginners and finance professionals.

Let me know if you’d like this turned into a PDF, checklist, or formatted for a training presentation.

I am a skilled content writer with 5 years of experience creating compelling, audience-focused content across digital platforms. My work blends creativity with strategic communication, helping brands build their voice and connect meaningfully with their readers. I specialize in writing SEO-friendly blogs, website copy, social media content, and long-form articles that are clear, engaging, and optimized for results.

Over the years, I’ve collaborated with diverse industries including technology, lifestyle, finance, education, and e-commerce adapting my writing style to meet each brand’s unique tone and goals. With strong research abilities, attention to detail, and a passion for storytelling, I consistently deliver high-quality content that informs, inspires, and drives engagement.