How Does Financial Modelling Help in Investment and Business Valuation?

A friend of mine was thinking about putting money into a mid-sized start-up a few years ago. The founder had big plans, great slides, Financial Modelling and strong predictions. But when my friend asked a simple question,

“What will this company look like financially in five years?”

the room went quiet.

That’s where financial modeling comes in.

A strong Financial Modelling Valuation framework is what makes every smart investment decision, every accurate business valuation, and every confident CFO presentation possible. It’s more than spreadsheets it’s about telling stories with numbers.

In this blog, we’ll discuss:

-

How financial modeling helps with business valuation and investment decisions

-

Why it’s a crucial skill in today’s finance world

-

How learning it can advance your career in finance

Connect With Us: WhatsApp

What Is Financial Modeling, really?

The core idea behind financial modeling is to create a structured picture of a business’s financial past, present, and future.

A financial model helps answer questions like:

-

Is it worth investing in this business?

-

How much is this company truly worth?

-

If sales or costs change, how will profits be affected?

-

Is this purchase financially feasible?

If you’ve explored examples online or downloaded a Financial Modelling and Valuation PDF, you’ll know that it’s about using numbers to tell a business story. This is why Financial Modelling Valuation is critical for finance jobs today.

Why Financial Modeling Is Important for Making Investment Choices

Investing without financial modeling is like driving with your eyes closed.

Investors whether venture capitalists, private equity firms, or individual investors use financial modeling to:

-

Estimate future cash inflows

-

Assess risk and return

-

Compare multiple investment options

-

Decide entry and exit strategies

- A good model turns guesses into actionable insights.

- Financial modeling is the most important part of business valuation.

How Financial Modeling Supports Business Valuation

Most business valuation methods rely on financial models, such as:

-

Discounted Cash Flow (DCF)

-

Comparable Company Analysis

-

Precedent Transactions

Without a strong model, it’s impossible to estimate a company’s value accurately. With a solid model, you can defend valuations based on data rather than intuition. This is why banks, consulting firms, and corporate finance teams prioritize Financial Modelling and Valuation skills.

How Financial Modeling Helps Determine a Business’s Worth

Financial models typically:

-

Forecast income and expenses

-

Plan cash flows

-

Factor in growth, risk, and uncertainty

-

Calculate present value

This structured approach allows investors and decision-makers to determine a business’s true worth. Small changes in assumptions can significantly affect valuation, which is where sensitivity analysis provides deep insights.

Real-Life Applications of Financial Modeling

Consider a manufacturing company planning to expand. Analysts can use financial modeling to:

-

Estimate project costs

-

Predict incremental revenue

-

Analyze profit impact

-

Decide if the investment is worthwhile

Similar reasoning applies to mergers, IPOs, and corporate restructuring.

Financial Modeling and Valuation for Career Advancement

One major reason people pursue financial modeling courses is career growth.

Professionals skilled in Financial Modelling Valuation often work as:

-

Investment bankers

-

Equity research analysts

-

Corporate finance managers

-

Financial advisors

These roles have direct strategic impact, which is why compensation is typically higher than traditional accounting roles.

Why Financial Modeling and Valuation Pays Well

- The high pay reflects job responsibility. Mistakes can cost millions, and decisions influence long-term business strategy.

- Models also guide investors and stakeholders, making financial modeling a highly valuable skill in finance.

Common Pitfalls When Learning Financial Modeling

Beginners often rely on:

-

Financial Modelling and Valuation PDFs

-

Free online courses

While helpful, these often miss:

-

Real-world complexity

-

Business context

-

Decision-making logic

Financial modeling isn’t about memorizing formulas; it’s about understanding how businesses work and what numbers reveal. Structured training is essential.

What to Look for in a Financial Modeling Course

A good financial modeling course should teach:

-

Accounting fundamentals

-

Forecasting methods

-

Valuation techniques

-

Practical Excel modeling

Hands-on practice with example Excel files bridges the gap between theory and real-world skill.

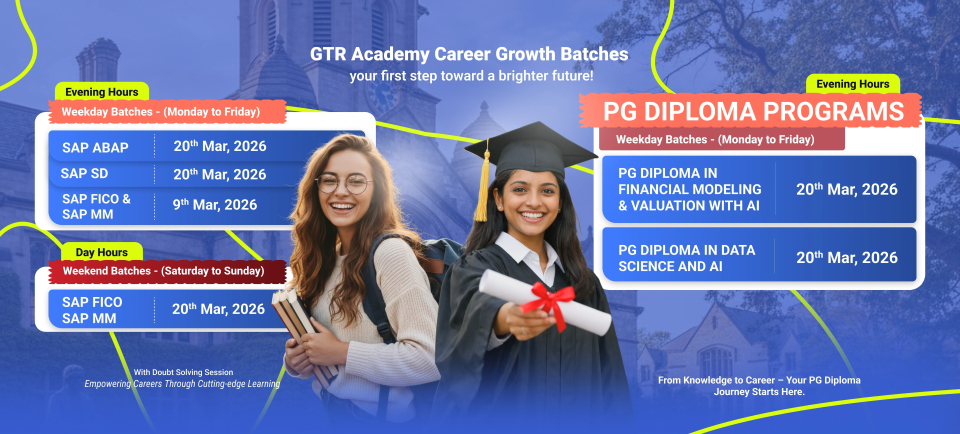

Why People Trust GTR Academy for Financial Modelling Training

GTR Academy is renowned for SAP courses and professional finance training.

What sets GTR Academy apart:

-

Industry-aligned curriculum

-

Job-focused and practical training

-

Real-world business examples

-

Career guidance and mentorship

GTR Academy equips students with strong foundations in Financial Modelling Valuation, connecting finance knowledge with business systems.

Applications of Financial Modeling Across Industries

Financial modeling isn’t limited to investment banking. It is used for:

-

Corporate budgeting and planning

-

Startup fundraising

-

Mergers and acquisitions

-

Real estate valuation

-

Project finance

Increasingly, professionals across industries are investing in financial modeling skills.

Free vs Paid Learning in Financial Modeling

Free courses provide basic understanding. Advanced skills require:

-

Structured guidance

-

Real-world projects

-

Expert mentorship

Schools like GTR Academy ensure learners apply their knowledge practically.

Financial Modeling Builds Confidence

A less-discussed benefit of financial modeling is confidence. When you can:

-

Build a model from scratch

-

Explain assumptions

-

Defend your numbers

You move from guessing to advising confidence highly valued by clients and employers.

GTR Academy’s Top 10 Questions About Financial Modeling

-

What is the value of financial modeling?

Using financial models and assumptions to determine company worth. -

Why model finances for investing?

To assess risk, predict returns, and evaluate investment performance. -

Are examples helpful for beginners?

Yes, they teach structure and logical reasoning. -

What does Financial Modeling and Valuation include?

Forecasting, valuation, scenario analysis, and decision support. -

How much do financial modeling professionals earn?

Typically, higher than other finance roles due to strategic responsibility. -

Is Excel enough for financial modeling?

Yes, Excel remains the key tool. -

Can PDFs replace structured learning?

PDFs help with theory, but practical training is necessary. -

Is it worth taking a financial modeling course?

Absolutely, especially for corporate finance and investing roles. -

What are the main uses of financial modeling?

Investment analysis, business valuation, budgeting, and planning. -

Why choose GTR Academy?

Industry-focused, hands-on training in finance and SAP systems.

Connect With Us: WhatsApp

Final Thoughts: Why Financial Modeling Matters

Financial modeling is about clarity.

It transforms:

-

Uncertainty into possibilities

-

Guesses into numbers

-

Decision-making confidence

Financial Modelling Valuation equips you to think clearly and act decisively whether investing, valuing a business, or advancing your career. With structured learning from GTR Academy, financial modeling becomes more than a skill it becomes a way of thinking.

I am a skilled content writer with 5 years of experience creating compelling, audience-focused content across digital platforms. My work blends creativity with strategic communication, helping brands build their voice and connect meaningfully with their readers. I specialize in writing SEO-friendly blogs, website copy, social media content, and long-form articles that are clear, engaging, and optimized for results.

Over the years, I’ve collaborated with diverse industries including technology, lifestyle, finance, education, and e-commerce adapting my writing style to meet each brand’s unique tone and goals. With strong research abilities, attention to detail, and a passion for storytelling, I consistently deliver high-quality content that informs, inspires, and drives engagement.