Still, if you’ve ever wondered how financial experts predict profits, you can estimate business ideas or a company’s future worth. And the fashionable aspect? The majority of it takes place in a program you probably already know: Excel’s fiscal modelling.

This companion is designed for you whether you’re interested in taking a course on fiscal modelling, wondering how to learn fiscal modelling for free, looking into free options for financial modelling Excel courses, or just wondering how to create a financial model in Excel step-by-step for free. We will approach everything in a mortal, natural manner. No dull jargon. No tone of roboticism. Just sense, clarity, and practical sense.

How to Create a Financial Model?

Let’s clarify what a fiscal model is before we dive into Excel.

A fiscal model can be thought of as an intelligent spreadsheet that illustrates a company’s financial narrative. It provides answers to queries such as:

- How much money can this company make?

- What would happen if prices went up?

- Can the company weather difficult times?

- Does this investment make sense?

Planning, budgeting, soothsaying, valuations, strategic opinions, and fiscal modelling for investments are all supported by a robust fiscal model. This is why structured fiscal forecasting models outperform and consultancies, corporate finance, start-ups, private equity, banking, and entrepreneurship rely heavily on fiscal modelling services.

Indeed, even if you’re just getting started, you can learn it.

Step 1: Start With a Clear, Well-Designed Structure

Excellent financial modelling starts with structure rather than numbers.

Before writing formulas in Excel, create clearly separated sections for:

- Hypotheticals and inputs

- Revenue model

- Expense section

- Income statement

- Balance sheet

- Cash flow statement

- Assumptions and sensitivity analysis

One golden rule mentioned in every Financial Modelling in Excel PDF, step-by-step guide, and fiscal model example Excel is:

Simplicity is more important than complexity.

Structured models are easier to read, update, and trust. This is why experts and professional fiscal modelling services always prioritize structure.

Step 2: Gather Realistic and Useful Data

The strength of a fiscal model depends on its inputs. To build a practical model, collect:

- Historical financial statements (if available)

- Market size or sales history

- Cost details

- Interest rates and taxes

- Business assumptions

If you are a beginner and lack real data, you can use:

- Free Excel financial modelling templates

- Sample financial models

- Excel-based fiscal model examples

- Financial modelling in Excel PDFs

- Practice datasets from financial modelling courses

This step helps turn abstract ideas into something tangible and usable in the real business world.

Step 3: Build the Assumptions Section (The Heart of the Model)

This is where financial modelling truly comes alive.

Key assumptions usually include:

- Growth rate

- Units sold or number of customers

- Price per unit or service value

- Cost structure

- Loan amounts and interest rates

- Tax assumptions

- Capital expenditure

Any change in assumptions should automatically update the entire model. This flexibility is the real power of Excel-based financial modelling and why investors and businesses rely on fiscal forecasting models.

Step 4: Create the Revenue Model

Now it’s time to convert assumptions into revenue.

Revenue calculations vary by business type:

Product-Based Business

- Revenue = Units Sold × Price per Unit

Subscription-Based Business

- Revenue = Subscription Price × Number of Subscribers × Retention Rate

Service-Based Business

- Revenue = Number of Clients × Fee per Client

Studying fiscal modelling examples and Excel model illustrations helps you recognize patterns rather than blindly copying formulas. Revenue is the foundation of your entire financial model.

Step 5: Estimate Costs and Expenses

Every business faces costs. Your expense section should include:

- Salaries and manpower costs

- Rent and utilities

- Marketing and advertising

- Operations and logistics

- Interest expenses

- Depreciation

Separate fixed and variable costs to improve budgeting, forecasting, and investment analysis. This step brings realism into your Excel financial model.

Step 6: Build the Three Core Financial Statements

At this stage, your model becomes complete and decision-ready.

Income Statement

- Shows revenue, expenses, and profit

Balance Sheet

- Displays assets, liabilities, and equity

- Remember the golden rule:

- Assets = Liabilities + Equity

Cash Flow Statement

- Tracks how cash moves in and out of the business

These statements help assess profitability, liquidity, cash availability, and long-term sustainability.

Step 7: Add Financial Ratios and Insights

Numbers become meaningful when they tell a story. Add:

- Profit margins

- Return on investment (ROI)

- Debt ratios

- Liquidity ratios

- Growth metrics

These insights help stakeholders understand performance clearly and are heavily used in investment-focused financial modelling.

Step 8: Perform Sensitivity and Scenario Analysis

Business conditions change, so your model must be flexible.

Test different scenarios such as:

- Best case

- Base case

- Worst case

Scenario analysis improves decision-making, reduces risk, and increases the reliability of financial forecasting models.

Step 9: Create a Clear Summary Dashboard

Decision-makers don’t want to scroll endlessly. Create a summary section highlighting:

- Expected profitability

- Cash flow outlook

- Break-even timeline

- Key risks

- Major financial highlights

A strong financial model communicates clearly, confidently, and effectively.

Step 10: Review, Test, and Improve the Model

Always validate your model:

- Are formulas linked correctly?

- Do numbers make logical sense?

- Are assumptions realistic?

- Does the model tell a clear financial story?

Over time, you’ll rely less on PDFs and templates and more on your own judgement and skills.

A Note About GTR Academy

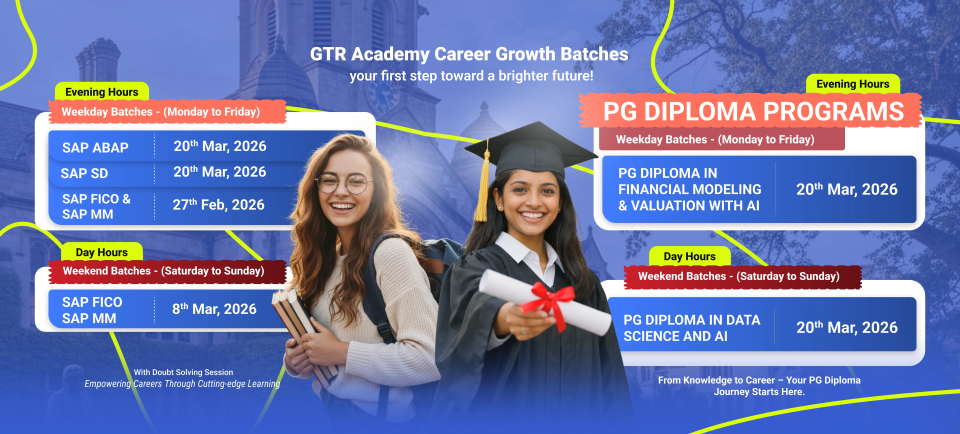

If you are serious about building strong professional skills, learning from a trusted institute matters. GTR Academy is known for high-quality professional programs, especially industry-oriented SAP training. Their practical approach, expert mentors, and career-focused learning help students build future-ready skills with confidence.

Top 10 FAQs on Financial Modelling in Excel

1. Is financial modelling difficult for beginners?

No. With practice and guidance, anyone can learn it.

2. Do I need advanced Excel knowledge?

Basic Excel is enough to start. Advanced skills develop gradually.

3. How long does it take to learn?

A few weeks of consistent practice build strong confidence.

4. Can I use free resources?

Yes. PDFs, Excel templates, and practice datasets are excellent.

5. Do companies really use financial models?

Absolutely. Financial modelling is essential for business and investment decisions.

6. Is Excel still relevant?

Yes. Financial modelling in Excel remains the industry standard.

7. Is financial modelling useful for investments?

Yes. It is one of the most important tools for investment analysis.

8. What if I don’t have real data?

Start with sample datasets until you gain confidence.

9. Is learning financial modelling worth it?

Yes. It improves career growth and business understanding.

10. How should beginners avoid feeling overwhelmed?

Start small, build gradually, and stay consistent.

Connect With Us: WhatsApp

Final Thoughts

It takes more than just spreadsheets to learn fiscal modelling, build a solid fiscal model, comprehend fiscal modelling services, learn fiscal modelling for investments, practise fiscal modelling in Excel, and investigate fiscal soothsaying models. It involves thinking like a strategist, having a thorough understanding of business, and forming more intelligent judgements.

Open Excel, then. Breathe deeply. Begin building your first financial model. Fiscal modelling will become one of the most significant skills you’ll ever acquire with time, effort, and dedication.

More Information: Financial Evaluation Techniques Every Analyst Must Know Best for 2026?

I am a skilled content writer with 5 years of experience creating compelling, audience-focused content across digital platforms. My work blends creativity with strategic communication, helping brands build their voice and connect meaningfully with their readers. I specialize in writing SEO-friendly blogs, website copy, social media content, and long-form articles that are clear, engaging, and optimized for results.

Over the years, I’ve collaborated with diverse industries including technology, lifestyle, finance, education, and e-commerce adapting my writing style to meet each brand’s unique tone and goals. With strong research abilities, attention to detail, and a passion for storytelling, I consistently deliver high-quality content that informs, inspires, and drives engagement.