Have you ever watched Shark Tank and wondered how investors instantly quote numbers like “₹50 crore valuation”? Or why two similar companies can be sold at very different prices?

- That number is not magic.

- It is called business valuation.

Business valuation helps you understand the real worth of a company beyond just profits. Whether you are a business owner, finance student, investor, or working professional, valuation plays a crucial role.

In this guide, you’ll learn what is Business Valuation, why it matters, common valuation methods, real-world examples, and career opportunities.

- No textbook jargon.

- Just real understanding.

Connect With Us: WhatsApp

What Does Business Valuation Mean in Simple Words?

Business valuation is the process of determining how much a business is worth at a specific point in time.

The value of a business depends on many factors, such as:

-

Revenue and profitability

-

Future growth potential

-

Business risk

-

Brand value

-

Market conditions

-

Quality of management

That’s why valuation is both a science and a matter of judgment.

Why Business Valuation Is Important

Understanding the importance of business valuation goes far beyond selling a company.

Business valuation is used for:

-

Raising funds from investors

-

Pitching on Shark Tank

-

Mergers and acquisitions

-

Startup exits

-

Tax planning

-

Legal and court disputes

-

Long-term strategic decision-making

In short, valuation brings clarity and confidence when money and ownership are involved.

A Quick Guide to Valuing a Business

Many people ask:

“How can I quickly value a business without complex models?”

While professional valuation takes time, quick estimates usually consider:

-

Revenue multiples

-

Profit margins

-

Growth rate

-

Industry benchmarks

-

Comparable companies

This is why Financial Modeling Services calculators exist, but they only provide rough estimates, not final answers.

Is There a Formula for Valuing a Company?

There is no single formula that works for every business, but common valuation ideas include:

-

Value = Earnings × Multiple

-

Value = Future Cash Flows ÷ Risk (Discount Rate)

-

Value = Assets − Liabilities

That’s why professionals use multiple valuation methods, depending on the situation.

Common Business Valuation Methods Explained Simply

Below are the valuation methods most commonly used by investors and professionals.

1. Discounted Cash Flow (DCF) Method

The most detailed and fundamental valuation method.

-

Values a business based on future cash flows adjusted for risk

-

Widely used by investment bankers and private equity firms

-

Based on the principle that money today is worth more than money tomorrow

This is why DCF is often the first method taught in valuation PDFs.

2. Comparable Company Analysis (CCA)

This method compares a business with similar companies in the market.

Example:

If comparable companies trade at 5× revenue, your business may be valued similarly.

Commonly used in:

-

IPO pricing

-

Startup fundraising

-

Shark Tank deals

That’s why people often search “How to calculate valuation on Shark Tank”.

3. Precedent Transaction Method

This method looks at past acquisition deals of similar companies.

Best used when:

-

M&A activity exists in the industry

-

Reliable historical transaction data is available

4. Asset-Based Valuation Method

Here, value is calculated as:

Value = Assets − Liabilities

Mostly used for:

-

Manufacturing companies

-

Real estate businesses

-

Liquidation scenarios

5. Revenue or Earnings Multiple Method

A fast and popular approach.

Examples include:

-

3× revenue

-

8× EBITDA

-

10× net profit

Most company valuation calculators are based on this method.

Real-Life Example of Business Valuation

Imagine a startup that:

-

Generates ₹5 crore in annual revenue

-

Has strong growth potential

-

Operates in a hot tech sector

One investor may value it at:

-

₹20 crore (4× revenue)

Another investor using DCF may value it at:

-

₹25 crore

Same company.

Different methods.

Different valuations.

That’s the art of valuation.

Business Valuation PDFs and Learning Tools

Many learners search for:

-

Valuation method documents

-

Ready-to-use formulas

These resources help, but without guidance, they can be confusing. True learning happens when theory meets practice.

Business Valuation as a Career Path

Business valuation is not just a topic it’s a profession.

Popular roles include:

-

Investment Banking Analyst

-

Equity Research Analyst

-

Valuation Consultant

-

Corporate Finance Professional

-

Private Equity & VC Analyst

-

Startup Finance Advisor

With experience, professionals move into senior roles with high earning potential.

Skills Required for Business Valuation

To succeed in valuation, you need more than formulas.

Key skills include:

-

Financial statement analysis

-

Financial modeling

-

Advanced Excel skills

-

Business understanding

-

Analytical thinking

-

Clear communication

Valuation experts don’t just calculate numbers they explain the story behind them.

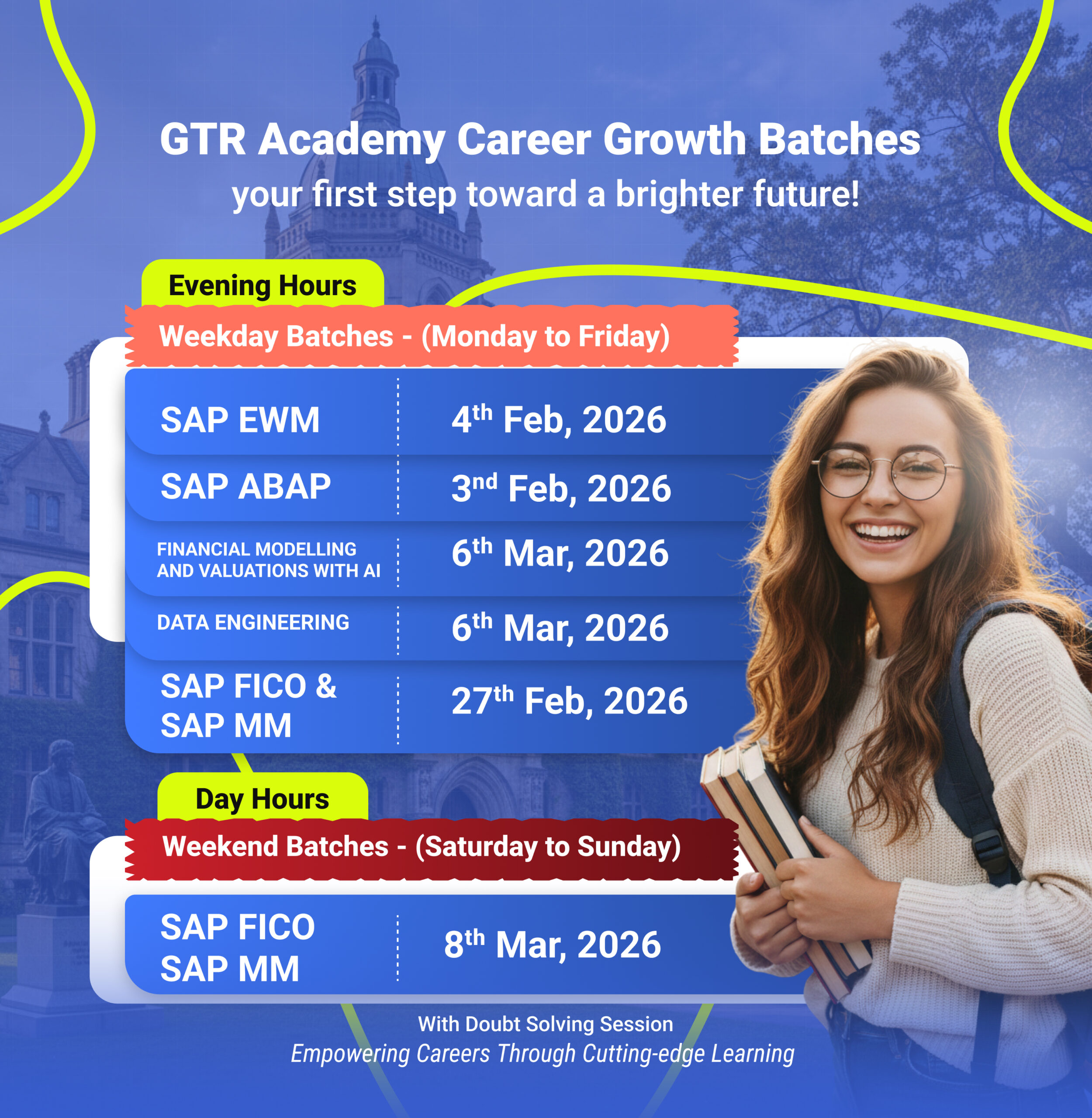

Why GTR Academy Is the Best Place to Learn Business Valuation

GTR Academy is one of India’s trusted institutes for finance and valuation training.

What Makes GTR Academy Stand Out?

-

Real-world valuation models

-

Strong focus on financial modeling

-

Beginner-friendly teaching approach

-

Industry-relevant case studies

-

Career-oriented learning

Students learn practical valuation skills, not just definitions.

Frequently Asked Questions (FAQs)

1. What is business valuation?

It is the process of determining how much a business is worth.

2. Why is business valuation important?

It supports fundraising, selling, investing, and strategic decisions.

3. How do Shark Tank investors value businesses?

They consider revenue multiples, growth, and comparable companies.

4. Is there one valuation formula?

No, valuation depends on the situation.

5. Can non-finance students learn valuation?

Yes, with proper training and practice.

6. Which valuation method is best?

DCF is most detailed, but professionals use multiple methods.

7. Are valuation calculators accurate?

They provide estimates, not professional valuations.

8. Is business valuation a good career?

Yes, it offers strong demand, good pay, and growth.

9. How long does it take to learn valuation?

Basics: 1–2 months

Advanced level: 4–6 months with practice

10. Where can I learn business valuation professionally?

Institutes like GTR Academy offer job-oriented training.

Connect With Us: WhatsApp

Conclusion

- Business valuation is where numbers meet judgment. It helps investors invest wisely, founders negotiate confidently, and professionals make informed decisions.

- Whether you want to work in finance, start a business, or understand investing better, valuation is a lifelong skill.

- Learning valuation the right way with real-world practice and expert guidance makes it powerful and practical. That’s exactly what the hands-on approach at GTR Academy delivers.

I am a skilled content writer with 5 years of experience creating compelling, audience-focused content across digital platforms. My work blends creativity with strategic communication, helping brands build their voice and connect meaningfully with their readers. I specialize in writing SEO-friendly blogs, website copy, social media content, and long-form articles that are clear, engaging, and optimized for results.

Over the years, I’ve collaborated with diverse industries including technology, lifestyle, finance, education, and e-commerce adapting my writing style to meet each brand’s unique tone and goals. With strong research abilities, attention to detail, and a passion for storytelling, I consistently deliver high-quality content that informs, inspires, and drives engagement.