Treasury Roles in 2026 Have Evolved Beyond Cash Handling

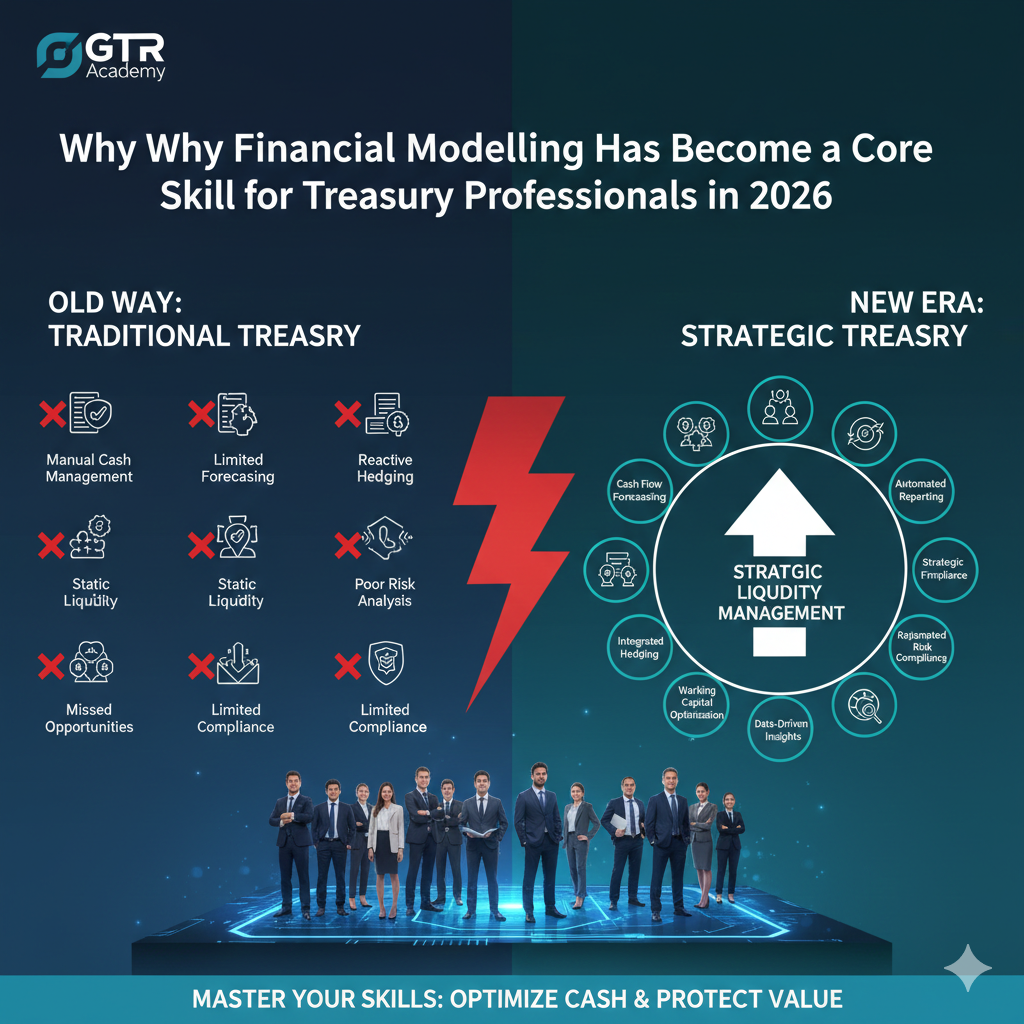

Once upon a time, the treasury department was merely the custodian of cash, liquidity as well as a manager of bank operations. However, by 2026 things have changed significantly; treasury teams have become the financial powerhouses of the organizations whose roles are not only limited to but greatly focused on identifying ways to mitigate the effects of global volatility, changes in interest rates, currency risks, and debt management.

Therefore, treasury professionals nowadays are expected to be analytical thinkers, proficient forecasters and decision-makers’ supporters, and hence financial modelling has become really important to anyone working in treasury.

Connect With Us: WhatsApp

Financial Modelling Facilitates Cash & Liquidity Management With a Greater Degree of Accuracy

Among the various responsibilities of the treasury function, cash & liquidity management is the highest ranking one. It is through financial modelling that treasury teams can:

-

Create rolling cash flow forecasts

-

Determine when cash might be in short supply or excessively abundant

-

Review the flow of money in and out of the business over time

-

Test the adequacy of cash under different stress scenarios

-

Schedule and control cash requirement at any day, week or month

By the use of financial models, the treasury departments in 2026 will be able to avert liquidity crises hence ensuring smooth running of business without a hitch.

Financial Modelling Is Crucial for Treasury as it Engages in Debt Planning & Capital Structure Decisions

Most treasury activities revolve around corporate debt including loan structuring, refinancing, and interest rate cost management. Financial modelling gives treasury teams the power to:

-

Break down and understand various debt instruments

-

Evaluate pros and cons of fixed and floating interest loans

-

Work out the impact of interest cost

-

Predict the timing of loan repayments

-

Appraise options of refinancing

-

Determine the most advantageous capital structure

In the absence of modelling, treasury departments will find it difficult to justify their suggestions as well as come up with the best borrowing plans.

Supports FX (Foreign Exchange) Risk Management

Businesses that operate internationally are always subject to foreign exchange exposure.

Through financial modelling treasury:

-

Will be able to predict the foreign exchange impact on the revenue and costs

-

Will conduct a thorough analysis of the different hedging strategies

-

Can conceptualize the possible changes in the currency values

-

Will carry out the testing of hedge effectiveness

-

Can eliminate losses stemming from global market fluctuations

By 2026, if you want to manage international operations, you cannot do away with FX modelling.

Treasury Professionals Must Perform Scenario & Stress Testing

The year 2026 brings us a mix of economic situations where one cannot predict, anticipate, or count on the stability of any parameter; such as rising interest rate hikes, the growth of inflation, and fluctuating currencies.

Therefore treasury departments utilize financial modelling for:

-

The modeling of a high-interest-hike plot

-

Understanding the effects of a downturn

-

Identification of the cash shortfall scenarios

-

Spotting a debt covenant was broken

-

Determining the effects of a foreign exchange rate shock

This type of financial planning is simply walking the extra mile, and it can keep an organization resilient no matter the market situation.

Necessary for Bank Relationship & Funding Decisions

Contemporary treasury people have learned to use the language of the banker—and that language is numbers. Equipped with financial modelling, treasury teams can:

-

Craft a case for the funding needs

-

Show how they will repay

-

Request for better credit terms

-

Use their treasury performance report to lure new lenders

-

Substantiate the creditworthiness of the company

In 2026, any banking deal done without the financial modelling teams participation is a waste of time.

Enhances Strategic Insight & Leadership Communication

Global treasury functions across corporations mostly report to CFOs or other senior executives.

Financial modelling is a powerful tool for treasury teams to demonstrate their understanding of various areas such as:

-

Interest rate risk

-

Funding strategy

-

Cash flow projections

-

Working capital efficiency

-

Risk mitigation plan

-

Investment opportunities

Within a company, the treasury exec is always the expert on the use of data and in presenting independent and well-grounded evidence thus becoming an effective leader.

Accelerates Career Growth in Treasury

Treasury practitioners who are excellent in financial modelling will have many more doors to walk through in their career paths such as:

-

Treasury Manager

-

Treasury Risk Lead

-

Corporate Finance Manager

-

Strategic Finance Head

-

Group Treasurer

-

Future CFO Track

There will be a close link between treasury roles and modelling skills during the 2026 era. Apart from being a modeller, the possession of other qualities will determine how fast one progresses.

Conclusion: Treasury in 2026 Runs on Financial Modelling

With treasury focusing more on transactional matter, the treasury function shifted into the business of strategy, forecasting and financial risk management. Financial modelling at 2026 treasury performance is the mainstay of different plans and strategies in place.

A powerful career in treasury can be built only if one masters financial modelling thus staying relevant, credible, and ready for the future.

Contact Us:

Phone: +91 9650518049

Website: gtracademy.org

GTR Academy

Ambition you may have. Direction we shall give.