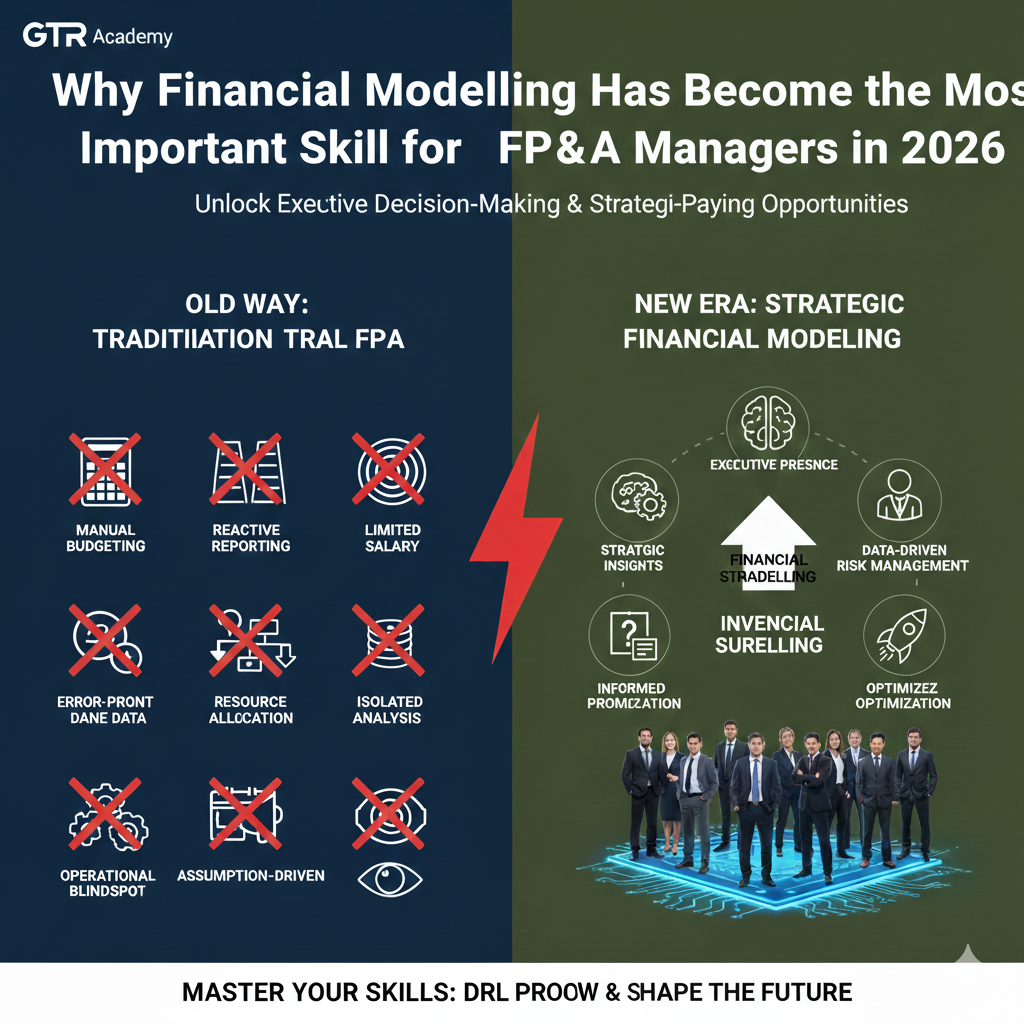

FP&A roles have changed from being mainly focused on reporting to becoming the strategy arm

In 2026, the Financial Planning and Analysis (FP&A) function has witnessed a profound change. From being a mere reporting and budgeting unit, FP&A has now become the analytical nucleus around which company decision, making revolves.

Among the things that FP&A teams influence today are:

Budget planning

Forecasting

Cost strategy

Business performance analysis

Investment planning

Operational decision, making

As a result of this transformation, financial modelling has overtaken other traditional skills of FP&A managers, in that it is now considered the most important business skill altogether.

Connect With Us: WhatsApp

Financial modelling enables accurate forecasting

The core of FP&A is forecasting. By 2026, it is expected that the forecast will be realistic, data, backed, frequently updated and flexible enough to reflect changes in the environment.

Financial modelling equips FP&A managers with tools to:

Develop forecast frameworks;

Build three, statement models;

Estimate revenue and cost projections;

Identify key business drivers;

Update forecasts immediately with the input of new data.

Forecasting without financial models is like predicting the weather without any scientific instrument, something that companies in the future 2026 cannot afford to do.

Highly relevant for Scenario and Sensitivity Analysis

Due to rapid changes in market conditions, it is indispensable that FP&A managers should consider several potential scenarios.

Financial modelling provides an opportunity for the team to test:

Best, case scenarios,

Worst, case scenarios,

Demand, fluctuation scenarios,

Cost, inflation scenarios,

Pricing impact analysis.

The upshot of this is that the management is ready for any kind of disruptions, therefore taking wiser decisions and achieving faster responses to uncertainties.

Equip FP&A Managers to Become Strategic Business Partners

Today, FP&A is closely intertwined with business functions such as sales, operations, HR, and supply chain.

Financial modelling enables FP&A managers to be the first point of contact between numbers and business departments.

The use of modelling allows them, for example, to:

Break down the financial consequences of business decisions

Offer data, driven advisory to business teams

Help in formulating business strategy

Bring the financial and operational sides of the business in sync

FP&A leaders who lack modelling capabilities in 2026 find it hard to touch the decision, making process or even get leadership’s confidence.

Facilitates quicker month, end and real, time analysis

The trend with companies is to go for real, time performance monitoring as opposed to the traditional monthly reporting cycles.

Financial modelling makes it possible for FP&A teams to:

Automate calculations

Create dynamic dashboards

Produce real, time insights

Reduce manual effort

Shorten month, end timelines

This effectiveness has made modelling one of the top productivity skills for FP&A teams.

Boosts FP&A Career Advancement

Since FP&A is a function of great exposure and impact, the possession of modelling skills will have a direct input on one’s promotion, salary hike and leadership abilities.

An FP&A manager who is highly skilled in financial modelling has a better chance of climbing the promotional ladder at a faster pace to the following positions:

FP&A Lead

Finance Manager

Finance Business Partner

Head of FP&A

Director, Strategic Finance

In 2026, financial modelling will differentiate the top performers of FP&A from the average ones the most.

In conclusion, modelling is the essential FP&A skill of the future

FP&A in 2026 is not about playing with numbers, it’s about figuring out the right moves.

Financial modelling is the key to achievement for FP&A managers in the following ways:

Delivering more accurate forecasts

Uncovering deeper business insights

Aligning more effectively with the strategy

Enabling faster reporting

Increasing the quality of decisions

Mastering financial modelling makes professionals the go, to partners for corporate decision, making and on top of that, it is the key to the fastest career progression in the finance world.

Contact Us:

Phone: +91 9650518049

Website: gtracademy.org

GTR Academy

Ambition you may have. Direction we shall give.